ESG

ESG (Environmental, Social, and Governance) refers to the criteria businesses use to assess sustainability, ethics, and corporate governance. KDS is actively involved in this space by integrating ESG principles into their operations, promoting responsible environmental practices, social inclusivity, and strong governance to drive sustainable business growth.

GreenCo

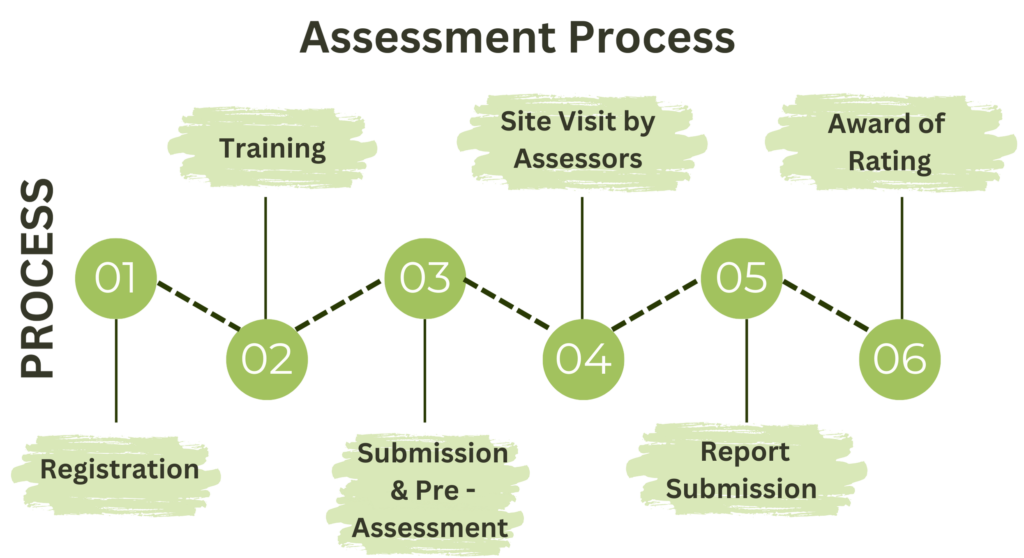

GreenCo certification, an Indian Green Building Council (IGBC) initiative that evaluates and promotes sustainable practices in industries and organizations. GreenCo helps companies improve their environmental performance while contributing to national sustainability goals.

GreenCo certification is essential for companies looking to enhance their environmental footprint and gain recognition for their sustainability efforts. It provides a structured framework to improve resource efficiency, reduce carbon emissions, and foster a culture of sustainability, making businesses more attractive to eco-conscious investors and customers.

GreenCo certification is awarded based on points earned in each assessment area. Companies are rated at different levels based on their total score:

- Level 1: Certified: Minimum score (350-449)

- Level 2: Bronze: Intermediate performance (450-549)

- Level 3: Silver: Growing performance (550-649)

- Level 4: Gold: High-level performance (650-749)

- Level 5: Platinum: Best-in-class sustainability practices (>750)

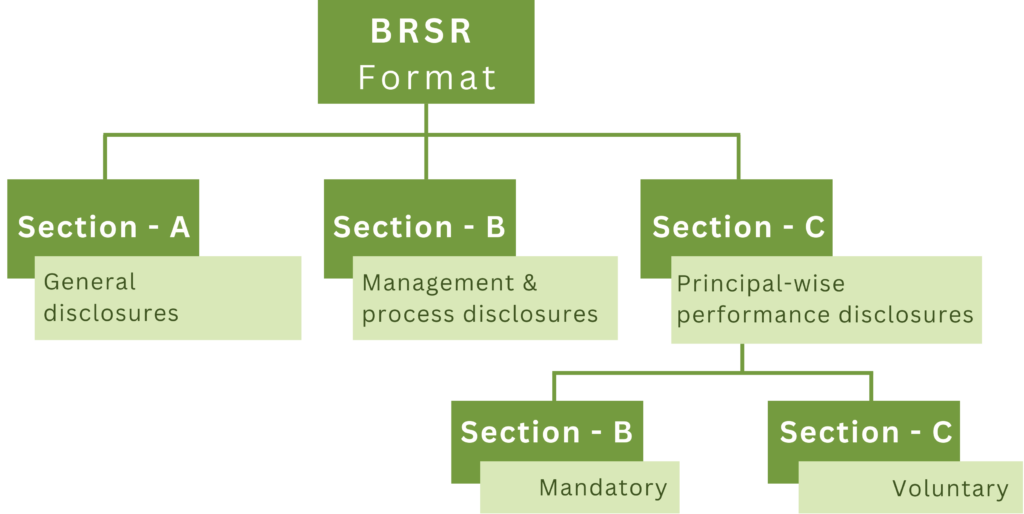

Business Responsibility and Sustainability Reporting (BRSR)

Responsibility and Sustainability Reports (BRSR) is a mandatory disclosure framework in India that enables companies to report on their environmental, social, and governance (ESG) practices, aligning with the growing emphasis on corporate responsibility and sustainability.

BRSR is crucial for companies to demonstrate their commitment to sustainable development and responsible business practices. It helps in building trust with investors, customers, and other stakeholders by providing a transparent view of the company’s ESG performance. Additionally, BRSR compliance is increasingly becoming a key factor in investment decisions, as stakeholders prefer businesses that prioritize sustainability.

Reporting in accordance with the Securities and Exchange Board of India (SEBI) guidelines, ensuring comprehensive and accurate disclosures.

Deadline for BRSR reporting for a financial year:

- Financial Year End: March 31

- AGM Deadline: September 30

- Annual Report Filing Deadline (BRSR is a part of annual report hence the same deadline) : Within 21 working days from the date of the AGM, generally by mid to late October

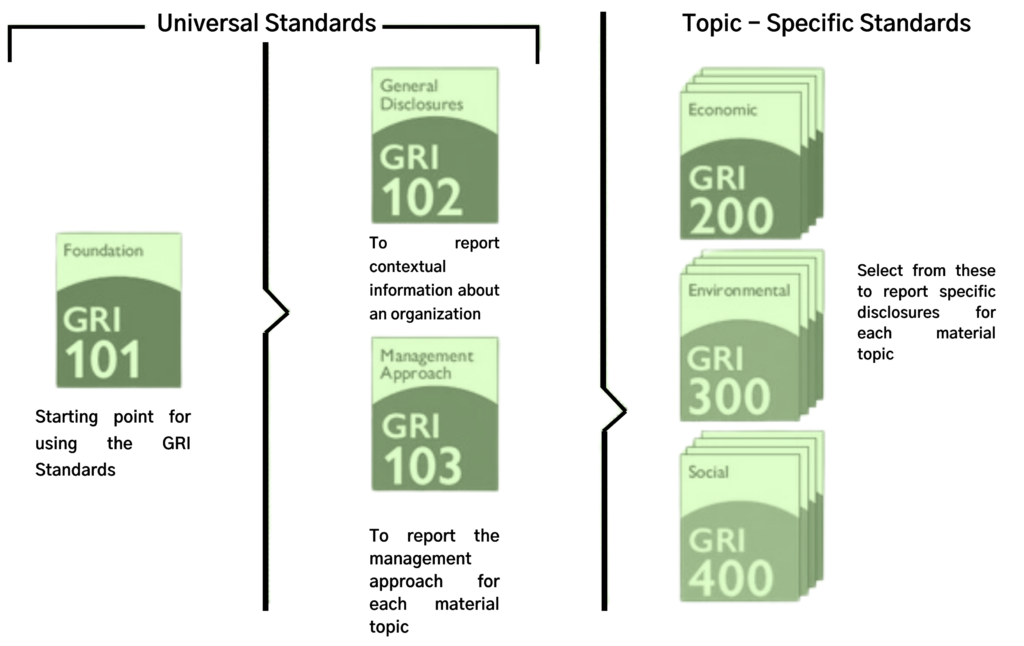

Global Reporting Initiative (GRI)

Global Reporting Initiative (GRI) Standards. The GRI framework is the most widely used sustainability reporting standard worldwide, helping organizations of all sizes and sectors communicate their ESG (Environmental, Social, and Governance) performance transparently and consistently.

GRI reporting is essential for companies aiming to enhance transparency, meet stakeholder expectations, and demonstrate their commitment to sustainability. A GRI-compliant report provides a comprehensive overview of your company's environmental and social impacts, making it easier for investors, regulators, customers, and employees to assess your corporate responsibility efforts.

Reporting Types:

- Core Reporting: Focuses on essential disclosures for significant ESG impacts.

- Comprehensive Reporting: Offers in-depth details on sustainability strategy and governance.

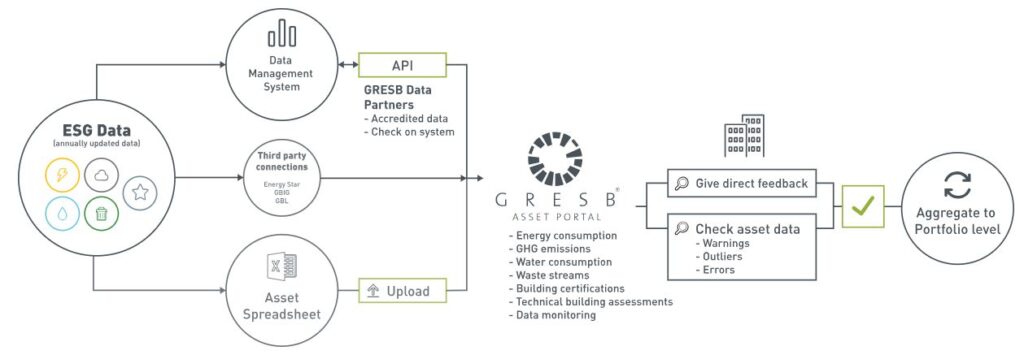

Global Real Estate Sustainability Benchmark (GRESB)

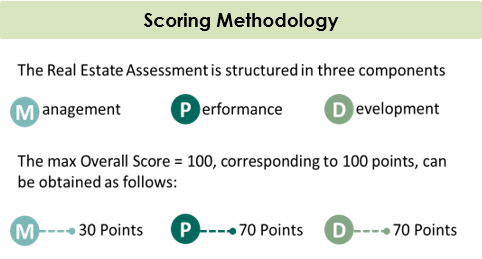

The Global Real Estate Sustainability Benchmark (GRESB) Assessment, a leading ESG (Environmental, Social, and Governance) benchmark for real estate and infrastructure investments worldwide. GRESB provides a rigorous framework for assessing the sustainability performance of real estate portfolios, infrastructure assets, and organizations. GRESB Assessment is vital for real estate and infrastructure companies seeking to enhance their sustainability credentials, attract responsible investment, and meet the growing demand for transparency in ESG performance. High GRESB scores are increasingly seen as a mark of excellence, making assets more attractive to investors who prioritize sustainability. GRESB offers two main types of assessments, Real Estate Assessment and Infrastructure Assessment The GRESB Assessment follows an annual cycle:

- Preparation Phase (January to March)

- Submission Phase (April to July)

- Validation and Scoring Phase (July to August)

- Results and Benchmarking Phase (September to October)

EcoVadis

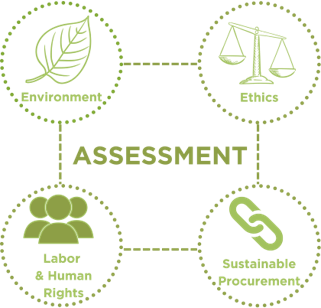

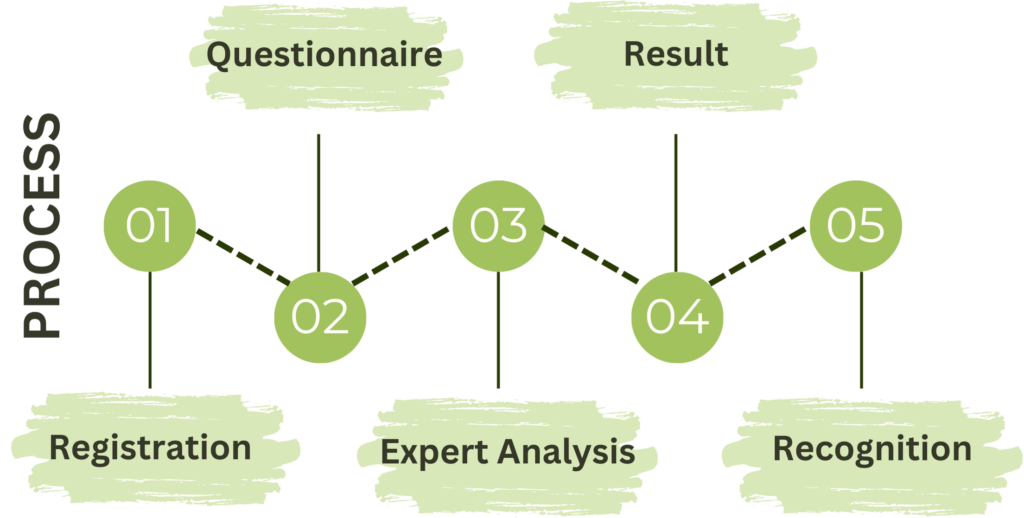

EcoVadis sustainability assessments, a leading platform for evaluating corporate social responsibility (CSR) and sustainability performance. EcoVadis is widely recognized by global companies and investors, helping businesses benchmark their ESG (Environmental, Social, and Governance) practices. An EcoVadis assessment enhances your company’s sustainability profile, boosts credibility with stakeholders, and helps secure responsible investment. High EcoVadis scores can strengthen market position by showing a commitment to ethical, sustainable business practices. EcoVadis evaluates companies across four key areas, Environment, Labor & Human Rights, Ethics, Sustainable Procurement .An EcoVadis scorecard that provides actionable insights into the company’s sustainability performance. EcoVadis scores companies on a scale from 0 to 100, with a performance rating from Bronze to Platinum based on the overall score:

- Bronze: 45-54 (top 1%)

- Silver: 55-64 (top 5%)

- Gold: 65-84 (top 15%)

- Platinum: 85-100 (top 25%)

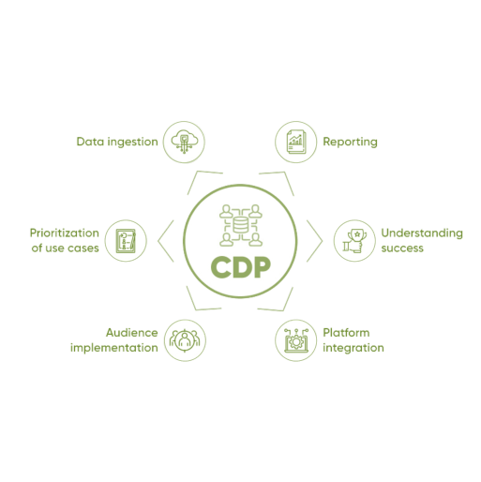

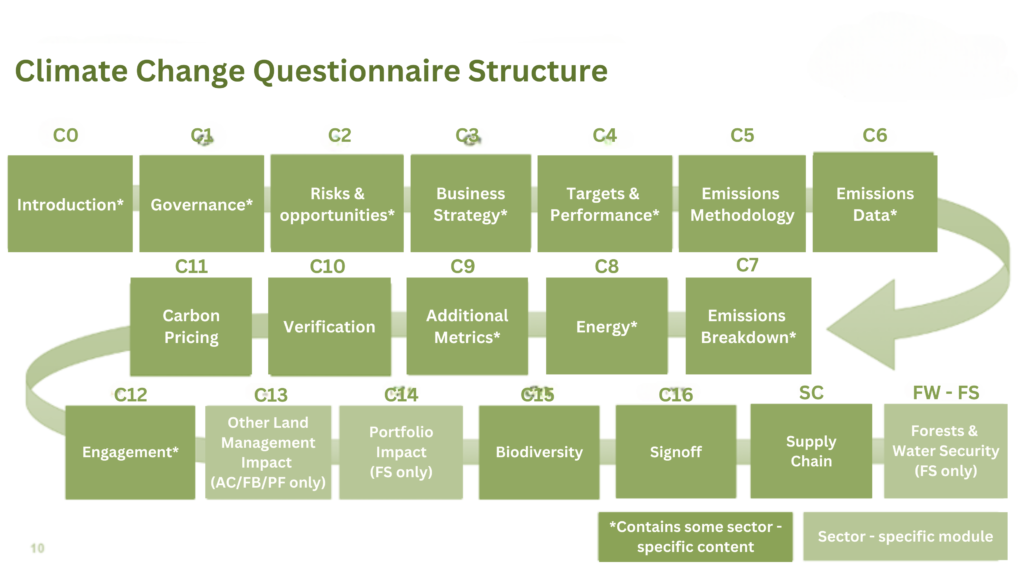

CDP (Carbon Disclosure Project)

Carbon Disclosure Project (CDP) reporting, a globally recognized platform that enables companies to disclose their environmental impact and climate change strategies. CDP is an essential tool for organizations committed to transparency, sustainability, and mitigating climate risks.

Participating in CDP reporting is crucial for companies aiming to demonstrate leadership in environmental responsibility. CDP scores are widely used by investors, customers, and other stakeholders to assess a company's commitment to addressing climate change, water security, and deforestation. A strong CDP score can enhance your company’s reputation, attract ESG-focused investors, and contribute to long-term business resilience.

Scores are awarded on a scale from D- to A, with A representing leadership and top performance. Companies with high scores are seen as environmental leaders in their industries.

A CDP score that reflects the company’s environmental performance. Submission is aligned with CDP’s annual disclosure cycle. CDP Reporting Standards to be followed for reporting

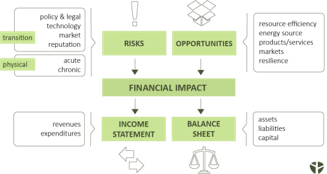

Task Force on Climate-related Financial Disclosures (TCFD)

Task Force on Climate-related Financial Disclosures (TCFD) is a globally recognized framework designed to help organizations disclose climate-related financial risks and opportunities, ensuring transparency and resilience in the face of climate change. TCFD reporting helps companies demonstrate preparedness for climate-related risks,. It supports financial risk mitigation, enhances resilience, and improves access to capital by integrating climate risks into financial planning. TCFD focuses on four key areas of climate-related disclosures:

- Governance: Your company’s governance structure and processes for overseeing climate-related risks and opportunities.

- Strategy: The impact of climate risks and opportunities on your business strategy and financial planning.

- Risk Management: The processes for identifying, assessing, and managing climate-related risks.

- Metrics & Targets: The key metrics and targets used to manage and assess climate-related risks and opportunities, including GHG emissions.

International Financial Reporting Standards (IFRS)

International Financial Reporting Standards (IFRS)is a Sustainability-related Disclosures that are globally accepted frameworks. It ensure transparency and consistency in financial reporting, particularly related to sustainability and ESG (Environmental, Social, and Governance) matters. It is essential for businesses aiming to provide reliable and comparable ESG information to investors, regulators, and stakeholders. Aligning with IFRS not only ensures regulatory compliance but also enhances transparency, builds investor confidence, and demonstrates your company’s commitment to sustainable growth. IFRS Sustainability Disclosure Standards focus on:

- Sustainability-Related Risks and Opportunities: Identification and disclosure of how sustainability issues affect financial performance and position.

- Governance: Oversight mechanisms for managing sustainability risks and opportunities.

- Strategy: Impact of sustainability on business strategy and financial planning.

- Metrics & Targets: Reporting relevant data on sustainability performance and progress toward sustainability targets.